1

Derivatives Rollover Report | February 25, 2021

For Private Circulation Only

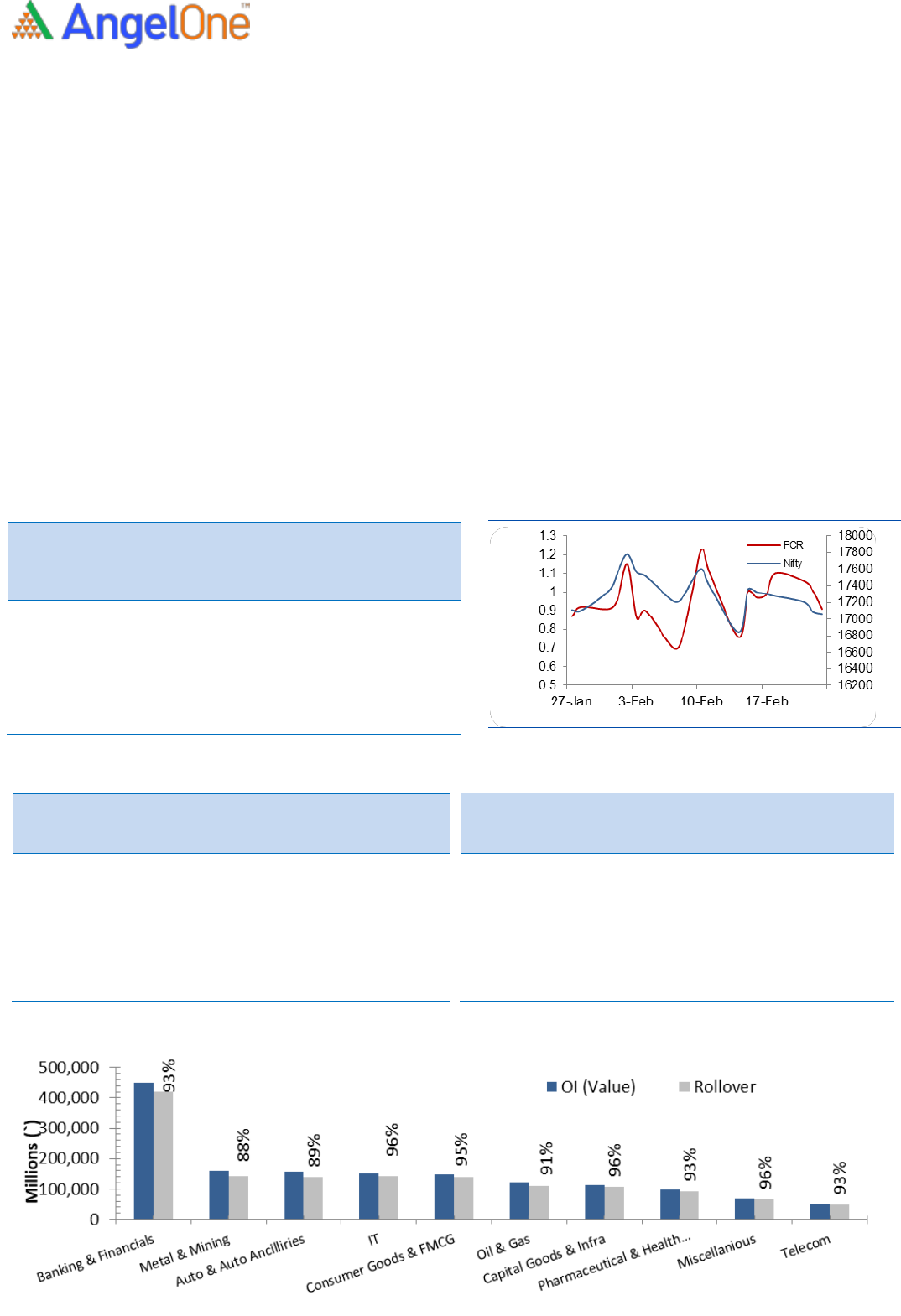

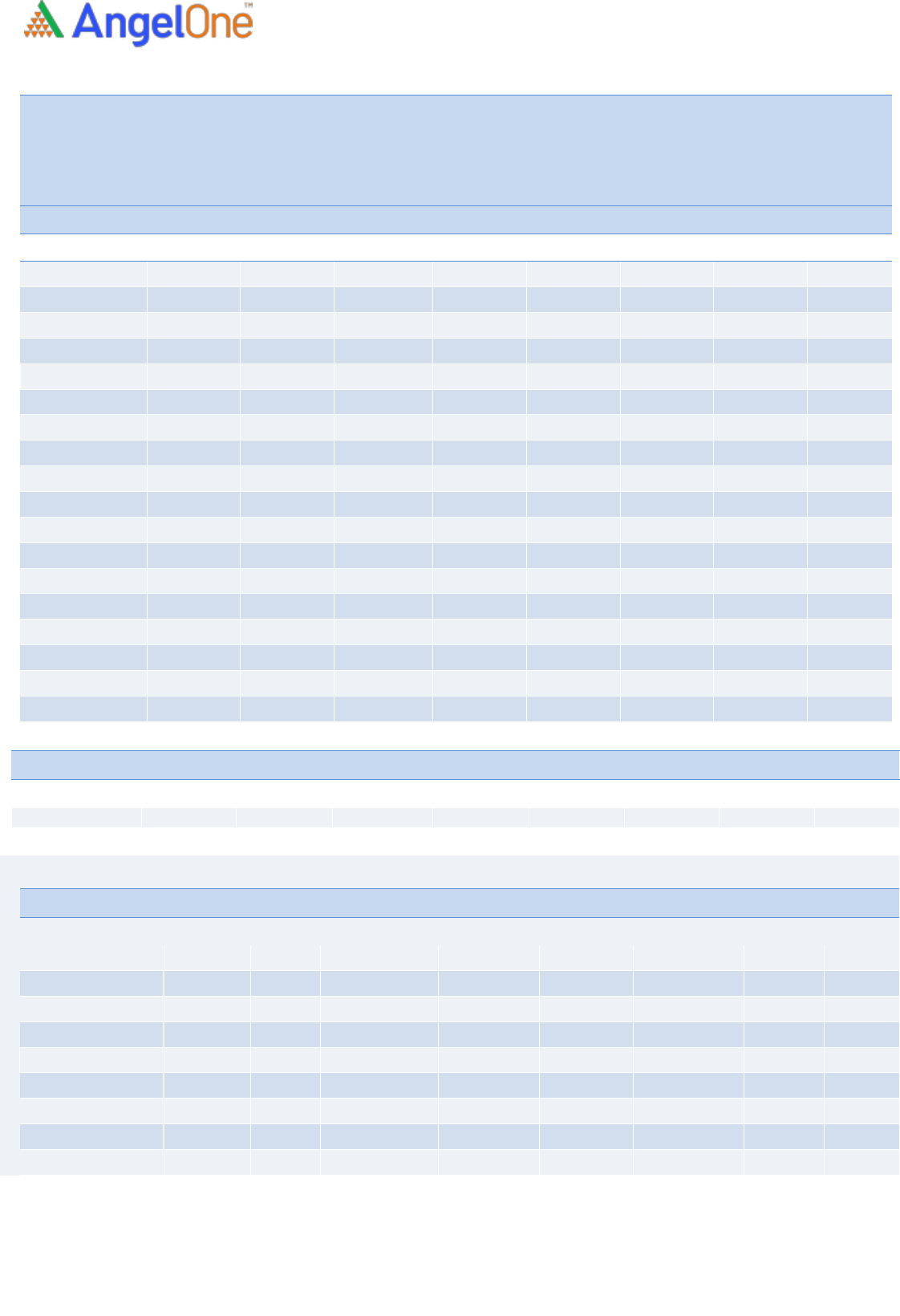

NIFTY & PCR Graph

Monthly Gainers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

GNFC

509.75

8.75

2834000

(14.11)

LAURUSLABS

502.60

8.16

5522400

6.27

HINDALCO

517.70

5.56

34406450

(0.91)

NATIONALU

M

112.00

5.36

89471000

(22.46)

INDIAMART

4346.00

(4.98)

323625

12.52

Note: Stocks which have more than 1000 contract in Futures OI.

Monthly Losers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

IBULHSGFIN

148.75

(28.91)

28222400

(18.56)

MANAPPURA

M

109.90

(28.29)

25548000

7.35

BHEL

44.35

(25.84)

105714000

(12.80)

NBCC

34.35

(25.08)

24060000

(36.61)

MCX

1181.90

(23.90)

1974000

(2.25)

Note: Stocks which have more than 1000 contract in Futures OI.

It was indeed an action packed month for the Indian equity market as we had an important event of Union Budget in the

first week and then the geo-political tension with respect to Russia and Ukraine in the final week of February series. We

witnessed benchmark index inching towards 17800 in the start and then attracted selling to almost test the 16800 mark.

This was followed by some respite to reclaim 17500 but due to global nervousness once again the selling reoccurred to not

only test 16800 but even to slide towards 16200 on the monthly expiry day as Russia finally invaded its neighbouring

country which had a complete outburst of fear across the global financial markets. We concluded the series with full of

roller coaster moves at the lowest point in last seven months.

Now let’s take a quick glance at the F&O activities. During the series, we saw mixed bets but majority was on the short side.

Rollover for Nifty and BankNifty stood at 77% and 76% respectively, which is certainly below the three month average. This

clearly indicates traders preferring staying light seeing the nervousness around the globe. Stronger hands continued their

selling streak in equities but added bullish bets in index and stock futures segment. Considering the above data points, we

would advocate staying light on positions. As far as levels are concerned, 16000-16200 is the immediate demand zone;

whereas, resistance is placed around 16800 followed by 17000 now.

Indices Change

INDEX

Price

Price

Change

(%)

Rollover

3 month

avg.

NIFTY

16247.95

(5.11)

77.22

78.35

BANKNIFTY

35228.10

(7.66)

76.23

81.94

FINNIFTY

16531.55

(8.49)

-

-

-

-

-

-

-

-

-

-

-

-

Derivatives Rollover Report

For Private Circulation Only

2

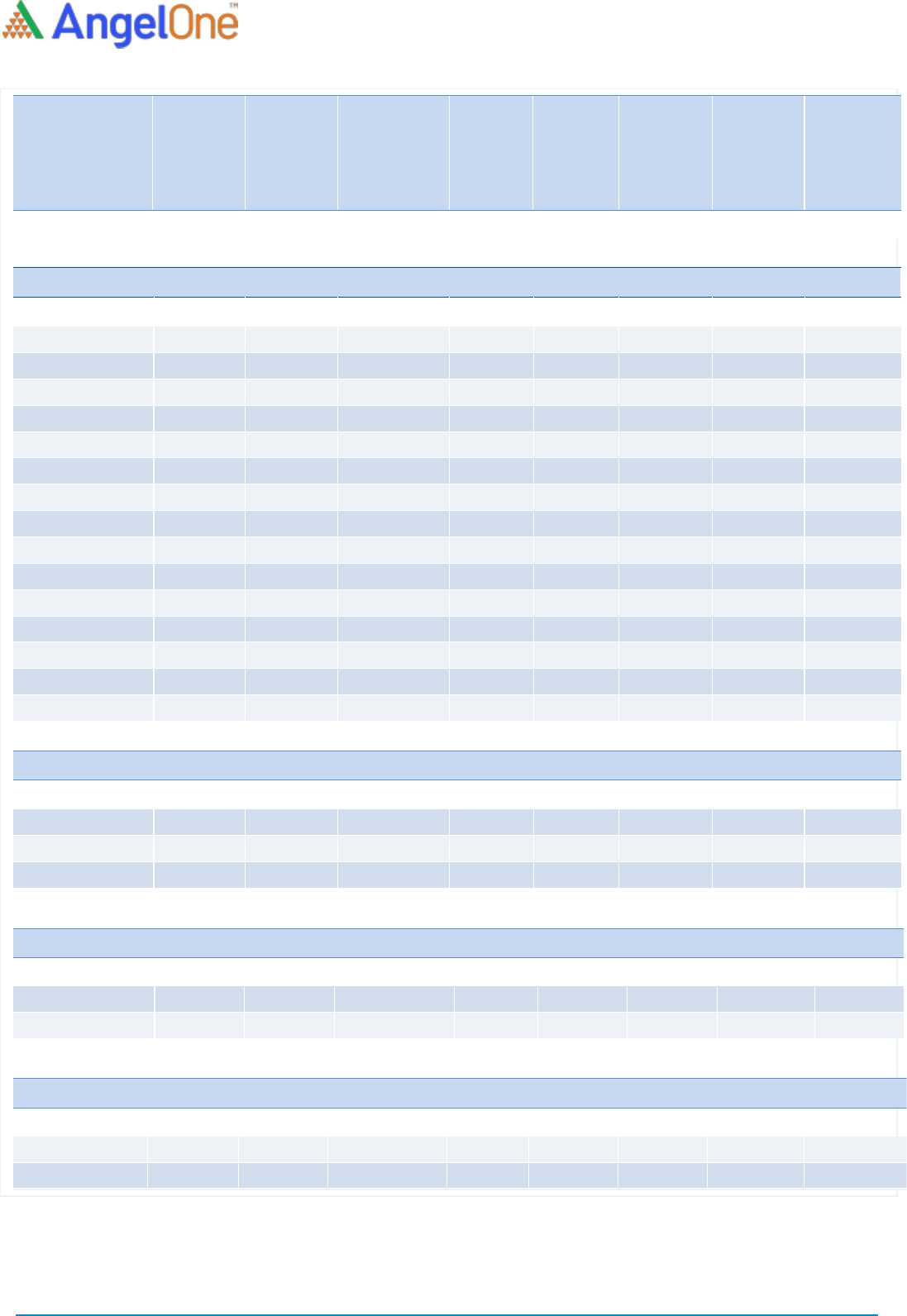

Scrip

Price

Price

Change

(%)

OI

Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

525.05

(12.50)

7860000

(28.00)

2.69

0.63

89.86

93.94

APOLLOTYRE

179.05

(15.60)

11017500

(4.55)

3.21

0.59

91.76

94.00

ASHOKLEY

113.90

(13.15)

34227000

6.93

2.29

0.57

91.00

92.38

BAJAJ-AUTO

3476.75

(0.86)

2013000

(27.90)

-0.60

0.57

96.44

96.35

BALKRISIND

1763.80

(22.01)

1453600

28.64

3.59

0.58

96.16

96.46

BHARATFORG

661.80

(8.45)

5460750

(15.50)

-9.06

0.51

96.42

97.49

BOSCHLTD

14857.65

(8.54)

120200

(20.16)

-11.09

0.64

96.28

96.58

EICHERMOT

2616.35

(1.47)

2797900

9.46

-0.28

0.74

95.74

97.35

ESCORTS

1782.70

(4.14)

4595800

(29.75)

-7.26

0.93

52.48

74.79

EXIDEIND

141.30

(17.99)

24105600

1.45

-0.74

0.69

92.72

91.91

HEROMOTOCO

2492.35

(6.31)

3201600

(14.33)

0.84

0.55

94.54

95.13

M&M

797.25

(7.26)

14083300

17.74

1.90

0.33

95.86

90.83

MARUTI

8224.30

(6.04)

2476900

(2.78)

1.80

0.51

91.40

93.93

MOTHERSUMI

144.70

(17.10)

22270500

(20.32)

1.08

0.67

92.65

95.56

MRF

63038.95

(10.90)

65450

13.59

-14.82

0.55

98.01

98.09

TATAMOTORS

427.55

(13.96)

71232900

(15.23)

-0.97

0.63

92.86

92.91

TVSMOTOR

617.90

(2.19)

7130200

(4.57)

-2.02

0.49

87.54

90.90

BANKING & FINANCIALS

AUBANK

1165.65

(8.84)

2479500

(16.89)

-12.29

0.65

93.76

95.87

AXISBANK

732.30

(5.50)

38383200

(23.44)

2.86

0.70

92.57

95.40

BAJAJFINSV

15277.25

(0.83)

637250

(7.47)

2.19

0.70

92.69

93.33

BAJFINANCE

6634.20

(3.46)

4123125

(11.38)

1.02

0.78

95.27

96.45

BANDHANBNK

291.40

(10.05)

21515400

(27.53)

0.72

0.66

92.53

93.46

BANKBARODA

100.85

(2.75)

98993700

(29.77)

3.63

0.72

94.14

94.37

CANBK

208.55

(13.64)

41509800

(19.86)

1.25

0.63

93.25

95.85

CHOLAFIN

648.60

(0.95)

8372500

2.15

1.21

0.54

95.80

97.02

CUB

122.65

(14.77)

10975200

(20.14)

-1.27

0.68

95.11

95.38

FEDERALBNK

93.60

(6.68)

61070000

(40.77)

-2.78

0.52

93.14

93.76

HDFC

2348.50

(6.69)

22439700

55.98

2.45

0.85

96.23

96.84

HDFCAMC

2017.40

(5.91)

2847800

(10.64)

-1.91

0.85

97.73

97.49

HDFCBANK

1422.70

(3.95)

26700850

(24.46)

2.42

0.67

95.22

95.86

IBULHSGFIN

148.75

(28.91)

28222400

(18.56)

2.11

0.66

85.03

72.70

ICICIBANK

708.10

(11.35)

97784500

25.85

1.03

0.70

95.56

92.90

ICICIPRULI

467.95

(14.33)

7344750

35.62

1.79

0.58

96.37

95.67

IDFCFIRSTB

38.70

(16.32)

145465500

(21.51)

-5.36

0.64

92.63

95.36

INDUSINDBK

876.70

(1.79)

24858000

(21.07)

1.25

0.59

97.01

96.09

KOTAKBANK

1787.15

(5.71)

13082800

(2.89)

-4.47

0.71

95.47

94.95

Derivatives Rollover Report

For Private Circulation Only

3

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

L&TFH

62.30

(14.42)

65662792

(19.68)

0.00

0.76

93.35

95.53

LICHSGFIN

331.00

(4.75)

20498000

(9.96)

2.84

0.50

92.65

93.31

M&MFIN

139.90

(10.61)

30516000

0.04

-6.30

0.60

94.69

93.30

MANAPPURAM

109.90

(28.29)

25548000

7.35

-1.89

0.46

90.81

93.23

MFSL

803.25

(9.92)

1418950

(29.17)

-8.37

1.00

97.67

97.66

MUTHOOTFIN

1303.60

(9.43)

2724375

(34.18)

-9.08

0.82

73.79

90.34

NAM-INDIA

298.90

(7.72)

2419200

(34.57)

-38.47

0.58

96.80

95.96

PFC

105.45

(11.54)

41471800

0.74

-57.03

0.71

85.35

90.51

PNB

32.25

(22.01)

119216000

(59.79)

8.15

0.79

59.59

84.06

RBLBANK

122.75

(20.19)

38198800

7.67

3.84

0.91

90.00

86.79

RECLTD

117.00

(12.85)

30408000

(25.14)

0.00

0.85

82.10

90.01

SBIN

471.80

(11.05)

71536500

(20.64)

-1.88

0.73

89.61

93.42

SRTRANSFIN

1066.40

(14.26)

3574400

(3.04)

-2.10

0.45

95.59

93.01

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

656.80

(7.50)

86385000

(5.48)

3.11

0.71

97.79

98.57

BHEL

44.35

(25.84)

105714000

(12.80)

0.00

0.63

94.92

96.17

GMRINFRA

34.60

(14.04)

84892500

(8.36)

3.02

0.65

90.74

94.73

HAVELLS

1148.35

(0.14)

3909500

(9.24)

0.86

0.61

97.60

92.23

LT

1759.65

(8.28)

12697725

(9.49)

1.36

0.84

92.99

87.90

SIEMENS

2291.00

0.40

1360425

(21.89)

2.37

0.41

96.73

89.89

VOLTAS

1172.30

0.61

3689000

(13.78)

-21.43

0.45

94.28

95.72

CEMENT

ACC

2019.70

(7.31)

2174250

(30.46)

2.95

0.78

97.34

95.71

AMBUJACEM

301.10

(14.51)

19390500

20.93

-19.88

0.32

95.77

95.44

GRASIM

1549.35

(8.72)

9964075

(2.22)

3.38

0.89

96.54

97.78

RAMCOCEM

765.65

(9.34)

1383800

(31.16)

-4.88

1.26

94.43

97.39

SHREECEM

23086.25

(3.67)

182700

(12.52)

-2.83

0.50

98.49

98.88

ULTRACEMCO

6728.40

4.54

1574200

5.44

9.68

0.43

96.14

96.10

CHEMICALS & FERTILIZERS

Derivatives Rollover Report

For Private Circulation Only

4

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

Consumer Goods & FMCG

ASIANPAINT

3073.10

(1.64)

4352550

11.30

1.41

0.76

96.09

95.11

BERGEPAINT

679.95

(5.11)

4413200

(12.48)

0.69

0.57

96.67

97.34

BERGEPAINT

BRITANNIA

3444.30

(1.60)

1432600

19.84

-0.48

0.81

97.05

95.36

BRITANNIA

COLPAL

1382.35

(1.11)

1930600

(36.02)

-11.12

0.93

83.21

92.97

COLPAL

DABUR

534.20

0.53

13386250

23.46

0.98

0.83

98.14

97.32

DABUR

GODREJCP

772.95

(12.37)

5954500

26.68

2.43

0.81

96.13

96.29

GODREJCP

HINDUNILVR

2177.45

(5.36)

9917100

(1.25)

2.91

0.77

96.07

96.14

HINDUNILVR

ITC

208.20

(1.30)

170870400

(25.39)

-1.50

0.86

92.78

94.29

ITC

JUBLFOOD

2884.95

(11.27)

2377250

14.66

0.14

0.54

91.16

94.61

JUBLFOOD

MARICO

484.85

5.28

8722000

(8.40)

3.13

0.45

97.64

91.60

MARICO

MCDOWELL-N

843.75

(0.11)

14942500

(11.71)

-0.99

0.58

97.75

98.08

MCDOWELL-N

NESTLEIND

17761.55

(3.72)

321050

3.46

1.01

0.78

96.35

96.31

NESTLEIN

D

TATACONSUM

679.90

(3.81)

11242800

(2.36)

3.39

0.38

95.51

96.75

TATACON

SUM

TITAN

2409.20

3.81

5759250

1.85

1.13

0.49

92.59

95.83

TITAN

UBL

1453.55

(2.93)

829500

(10.30)

-7.87

0.37

83.19

73.63

UBL

COALINDIA

293.80

1.71

14714400

2

9

.

8

0

8.26

0.35

63.04

65.79

HINDALCO

88.10

30.23

34330000

(

1

3

.

3

6

)

2.22

0.61

78.46

82.59

HINDZINC

1

0

8

.

5

9

METALS & MINING

COALINDIA

149.65

(6.82)

35347200

(23.25)

-2.43

0.50

79.03

88.21

HINDALCO

517.70

5.56

34406450

(0.91)

0.10

0.43

81.79

84.78

JINDALSTEL

370.45

(1.54)

28972500

(14.91)

1.83

0.60

96.13

97.62

JSWSTEEL

571.40

(8.95)

38272500

(8.49)

3.75

0.71

97.73

98.36

NATIONALUM

112.00

5.36

89471000

(22.46)

-0.47

0.50

95.41

96.93

NMDC

134.50

0.00

73639700

(19.71)

0.39

0.77

80.69

90.21

SAIL

84.85

(11.66)

150641500

(15.77)

-1.84

0.73

92.08

95.89

TATASTEEL

1075.80

(1.64)

42457925

(3.26)

1.70

0.76

97.73

97.75

VEDL

330.70

0.33

54101200

(17.52)

-22.67

0.60

66.17

81.73

TEXTILES

INFORMATION TECHNOLOGY

COFORGE

4185.05

(4.72)

493100

(24.01)

-10.09

0.46

73.67

77.32

HCLTECH

1101.65

1.70

20016500

(29.62)

2.94

0.68

95.23

87.08

INFY

1679.80

(0.25)

39786600

5.79

1.06

0.60

98.30

91.95

LTI

5607.60

(2.83)

952050

(5.86)

1.23

0.85

89.98

83.49

MINDTREE

3577.80

(0.41)

2743800

(7.02)

3.47

0.76

97.71

97.05

MPHASIS

2955.45

0.42

1553825

(11.44)

1.31

0.49

98.56

96.11

NAUKRI

4282.15

(2.66)

1661500

(1.40)

0.44

0.64

89.29

94.10

TCS

3411.85

(6.98)

13408200

11.94

3.11

0.49

90.82

92.48

TECHM

1333.75

(8.18)

15935400

(1.44)

0.59

0.73

91.53

92.17

WIPRO

0.00

0.00

35552000

(15.29)

-3.01

0.70

94.46

90.49

TELECOM

BHARTIARTL

350.55

0.39

34602594

(4.18)

7.10

0.90

89.38

87.82

IDEA

12.45

(7.43)

363300000

(10.52)

10.56

0.83

82.76

85.28

INFRATEL

276.95

1.58

6836000

3.14

10.20

0.49

84.58

83.89

TEXTILES

ARVIND

66.40

(15.36)

5862000

(11.53)

5.92

1.09

82.52

89.16

CENTURYTEX

959.75

(7.62)

3744000

5.98

-1.70

0.81

98.89

99.06

PAGEIND

20491.75

6.10

156325

9.82

-9.51

0

96.19

89.39

RAYMOND

739.95

(13.35)

2732800

4.75

7.00

1.38

97.21

96.63

Derivatives Rollover Report

For Private Circulation Only

5

Scrip

Price

Price

Change

(%)

OI

Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month

)

(%)

INFORMATION TECHNOLOGY

HCLTECH

564.00

(0.70)

22885800

(1.26)

8.14

0.58

98.56

96.78

INFY

730.55

3.77

24351600

(52.50)

2.86

0.74

55.98

79.52

MINDTREE

782.95

10.93

1041600

(14.29)

-15.63

0.59

93.13

93.37

NIITTECH

1606.65

6.68

578250

26.08

-2.03

0.46

89.76

82.99

TCS

2212.80

6.19

15671500

(17.22)

6.42

1.91

95.02

94.74

TECHM

775.75

1.00

15406800

8.21

9.05

0.65

96.29

97.15

WIPRO

249.90

3.65

18211200

(29.64)

-2.08

0.72

83.12

92.60

MISCELLANIOUS

ABFRL

250.75

(12.31)

12864800

6.68

-0.21

0.40

94.43

95.06

ADANIENT

1551.25

(8.40)

21242000

2.30

4.83

0.83

97.97

98.51

APOLLOHOSP

4386.00

1.66

2569125

(16.00)

0.96

0.51

97.88

96.35

ASTRAL

1784.85

(13.94)

1090375

2.53

0.96

0.57

97.11

95.73

BATAINDIA

1779.20

(9.09)

1277100

7.35

1.61

0.55

84.25

90.90

BEL

187.85

(7.80)

24293400

(26.25)

0.00

0.94

86.38

92.73

CONCOR

559.55

(9.19)

5468000

(3.38)

2.24

0.47

97.88

93.96

CUMMINSIND

928.15

2.72

1634400

8.10

0.56

0.44

90.26

88.52

HDFCLIFE

532.90

(14.57)

25646500

24.99

-0.10

0.65

94.37

93.89

ICICIGI

1238.75

(9.79)

2804150

(9.31)

-1.76

0.77

96.38

97.53

INDHOTEL

194.10

(3.46)

16136264

11.88

-1.07

0.50

90.50

92.45

INDIGO

1830.00

(2.20)

3197500

16.99

-0.37

0.57

93.53

96.31

IRCTC

737.65

(9.65)

9595250

(1.43)

-0.57

0.62

95.20

91.91

LALPATHLAB

2491.55

(8.83)

823250

(5.55)

-22.86

0.53

92.51

95.11

LTTS

4250.20

(2.99)

636200

(31.96)

-9.71

0.82

95.21

96.19

METROPOLIS

1990.00

(18.26)

625600

(11.91)

-4.20

0.46

86.70

85.21

SBILIFE

1055.50

(13.07)

7794750

5.50

1.29

0.48

95.97

92.44

TRENT

1021.30

(0.50)

2421500

(10.07)

0.66

0.68

97.38

83.22

MEDIA

PVR

1519.05

(1.66)

2281235

(27.10)

3.24

0.52

93.14

93.83

SUNTV

428.55

(9.73)

12096000

(1.45)

3.30

0.47

94.63

96.76

ZEEL

221.60

(21.94)

71310000

(7.94)

1.89

0.89

94.42

96.50

IGL

506.15

(1.77)

5178250

(23.81)

7.68

1.13

97.21

91.91

IOC

91.70

(9.79)

62803000

(12.25)

9.18

0.66

93.34

91.89

MGL

1142.20

(4.95)

1020000

(34.79)

1.01

0.96

95.18

90.39

ONGC

102.90

(13.13)

38269000

(13.29)

9.20

0.69

92.19

84.88

PETRONET

222.20

(14.51)

18006000

4.88

6.85

0.92

96.78

95.76

RELIANCE

2008.90

(6.90)

26297500

(1.73)

9.11

0.63

97.62

95.78

BPCL

470.70

11.69

44681400

8.98

8.89

0.51

93.84

91.32

BATAINDIA

1444.10

8.68

1488850

(10.54)

-2.88

0.42

93.06

94.61

BEL

115.85

1.49

22602000

(2.49)

10.21

0.44

97.34

96.42

MCX

659.60

(6.88)

2102100

(7.23)

11.16

0.79

93.26

90.88

MCX

1111.60

2.65

1348000

12.33

-3.27

0.66

92.87

80.54

OIL & GAS

BPCL

331.45

(12.11)

21826800

(27.34)

-5.01

0.82

83.03

92.27

GAIL

127.85

(9.45)

29780200

(20.44)

-15.27

0.65

78.91

87.74

GUJGASLTD

572.05

(17.18)

2291250

12.25

-1.18

0.82

93.47

95.07

HINDPETRO

269.75

(12.84)

8561700

(32.72)

-9.20

0.97

68.25

84.73

IGL

332.75

(15.63)

18114250

(7.05)

-4.84

0.65

93.00

94.80

IOC

108.70

(9.42)

32428500

(36.74)

-12.32

0.71

70.69

85.42

MGL

681.45

(15.10)

3763800

(24.77)

0.15

0.63

93.79

95.34

ONGC

156.50

(4.89)

31493000

(52.27)

-1.00

0.30

83.95

90.13

PETRONET

191.50

(9.78)

17916000

(8.63)

3.00

0.69

96.81

96.82

RELIANCE

2261.70

(3.65)

31145750

(8.25)

2.75

0.60

94.96

95.85

AUROPHARMA

1037.15

6.60

8765250

(5.00)

7.85

0.51

97.81

95.86

BIOCON

383.45

(3.23)

17434000

0.03

5.93

0.71

86.18

89.52

CADILAHC

629.55

11.44

22301400

43.30

6.29

0.51

95.72

93.45

CIPLA

946.80

3.82

10505950

(19.23)

6.89

0.53

91.10

89.74

Derivatives Rollover Report

For Private Circulation Only

6

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC

(%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

PHARMACEUTICAL

ALKEM

3180.00

(5.65)

287800

18.44

2.76

0.76

95.81

82.46

APLLTD

703.50

(4.81)

1638700

(12.88)

1.56

0.86

92.31

90.53

AUROPHARMA

606.50

(0.25)

13899750

(17.90)

1.81

0.63

95.35

95.46

BIOCON

375.45

4.00

12061200

(34.34)

3.62

0.60

95.50

96.11

CADILAHC

344.25

(10.48)

19811000

(13.94)

-1.51

0.76

93.23

94.92

CIPLA

896.00

(2.95)

9653800

(16.71)

0.29

0.57

81.93

88.10

DIVISLAB

3947.60

(0.30)

2541300

(17.67)

2.87

0.60

97.13

96.63

DRREDDY

4087.80

(4.20)

2723125

(5.12)

-1.21

0.83

95.74

86.71

GLENMARK

430.80

(9.68)

7208200

(15.99)

2.43

0.90

96.28

97.00

GRANULES

268.20

(8.74)

11445200

(17.74)

3.51

0.48

93.44

94.70

LUPIN

713.20

(19.82)

8954750

31.05

0.00

0.56

88.99

91.26

PEL

1950.00

(15.88)

4250675

25.57

0.67

0.73

95.08

96.82

PFIZER

4217.50

(5.11)

123875

(42.18)

-1.75

1.22

95.11

92.99

STAR

314.30

(16.16)

4091400

(19.60)

1.33

0.60

93.91

94.85

SUNPHARMA

820.75

1.48

21898100

(18.62)

3.19

0.54

95.71

91.43

POWER

NTPC

124.15

(6.51)

36069600

(32.33)

-2.10

0.47

69.53

83.22

POWERGRID

191.15

(10.38)

25902381

(23.98)

0.27

0.73

81.78

89.58

TATAPOWER

204.30

(15.72)

110754000

(12.15)

0.00

0.77

95.12

95.22

REAL ESTATE

DLF

320.55

(14.72)

40971150

33.11

0.16

0.60

93.61

95.88

GODREJPROP

1452.90

(10.22)

5170425

38.76

1.22

0.54

96.26

95.93

TELECOM

BHARTIARTL

671.80

(5.26)

57734350

(3.12)

1.40

0.57

94.51

95.87

IDEA

9.75

(8.45)

686560000

(0.91)

10.81

0.44

85.78

76.24

INDUSTOWER

197.80

(20.69)

20846000

57.50

-41.51

0.56

95.03

91.75

TEXTILES

PAGEIND

40152.00

(1.65)

89610

13.53

-1.14

0.15

88.90

87.89

Derivatives Rollover Report

For Private Circulation Only

7

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives

Sneha Seth Derivatives Analyst

sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst

rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a

Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research

Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the

securities of the subject company at the end of the month immediately preceding the date of publication of the research

report. Neither Angel or its associates nor Research Analysts or his relative has any material conflict of interest at the time

of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the

period preceding twelve months from the date of this report for services in respect of managing or co-managing public

offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a

merger or specific transaction in the normal course of business. Angel or its associates did not receive any compensation

or other benefits from the companies mentioned in the report or third party in connection with the research report.

Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a